Small Business Accountant Vancouver - An Overview

Table of ContentsThe Ultimate Guide To Virtual Cfo In VancouverHow Pivot Advantage Accounting And Advisory Inc. In Vancouver can Save You Time, Stress, and Money.Getting The Vancouver Tax Accounting Company To Work9 Simple Techniques For Tax Consultant VancouverExamine This Report on Tax Accountant In Vancouver, BcThe Best Guide To Virtual Cfo In Vancouver

Here are some advantages to employing an accounting professional over an accountant: An accountant can provide you an extensive view of your business's economic state, together with techniques and suggestions for making economic choices. Accountants are only liable for taping monetary transactions. Accounting professionals are needed to complete even more education, certifications and also job experience than bookkeepers.

It can be tough to evaluate the ideal time to hire an accountancy specialist or bookkeeper or to determine if you require one whatsoever. While several little businesses employ an accountant as an expert, you have numerous options for taking care of financial jobs. Some little service proprietors do their own bookkeeping on software application their accounting professional advises or makes use of, supplying it to the accounting professional on an once a week, monthly or quarterly basis for action.

It may take some background research to locate an appropriate bookkeeper due to the fact that, unlike accounting professionals, they are not called for to hold an expert certification. A strong endorsement from a trusted coworker or years of experience are crucial variables when employing a bookkeeper.

Unknown Facts About Vancouver Accounting Firm

:max_bytes(150000):strip_icc()/forensicaccounting-Final-85cc442c185945249461779bcf6aa1d5.jpg)

For local business, experienced cash money monitoring is a vital facet of survival and also development, so it's important to deal with an economic specialist from the beginning. If you prefer to go it alone, consider beginning out with accounting software and also maintaining your books diligently approximately date. In this way, ought to you need to work with a professional down the line, they will certainly have presence right into the total monetary history of your organization.

Some source interviews were conducted for a previous version of this write-up.

All about Small Business Accounting Service In Vancouver

When it involves the ins and outs of tax obligations, bookkeeping and also finance, nevertheless, it never injures to have a seasoned professional to resort to for support. An expanding number of accountants are also looking after things such as money flow forecasts, invoicing and HR. Inevitably, most of them are tackling CFO-like roles.

When it came to using for Covid-19-related governmental funding, our 2020 State of Small Business Study located that 73% of little company owners with an accounting professional stated their accounting professional's recommendations was crucial in the application process. Accounting professionals can likewise assist entrepreneur prevent costly mistakes. A Clutch survey of small company proprietors shows that greater than one-third of local the accountant rating business listing unpredicted costs as their leading monetary challenge, adhered to by the mixing of organization as well as individual financial resources and also the inability to obtain repayments on schedule. Local business proprietors can anticipate their accountants to aid with: Picking business structure that's right for you is vital. It impacts just how much you pay in taxes, the documents you require to file as well as your individual liability. If you're seeking to convert to a different organization framework, it might cause tax obligation repercussions and also various other complications.

Also firms that are the same size and industry pay very different quantities for accountancy. Prior to we obtain right into buck figures, let's speak about the costs that go right into little organization accounting. Overhead expenses are costs that do not directly turn into an earnings. These costs do not convert into money, they are needed for running your service.

The Cfo Company Vancouver Ideas

The typical cost of audit solutions for local business differs for each and every one-of-a-kind situation. Given that accountants do less-involved jobs, their prices are usually less expensive than the accountant review ben affleck accountants. Your monetary solution cost depends on the job you require to be done. The ordinary month-to-month accountancy charges for a small company will increase as you include extra solutions straight from the source as well as the tasks get tougher.

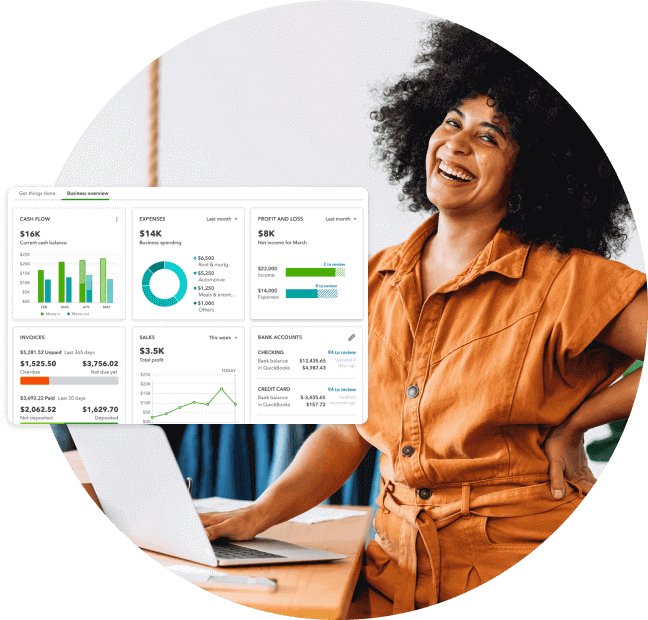

You can tape transactions and also process pay-roll making use of on the internet software program. Software options come in all forms and dimensions.

The Small Business Accounting Service In Vancouver Statements

If you're a brand-new local business owner, do not forget to element accountancy prices into your budget plan. If you're an expert owner, it may be time to re-evaluate audit expenses. Management prices and accountant charges aren't the only audit expenses. Pivot Advantage Accounting and Advisory Inc. in Vancouver. You should likewise consider the impacts accountancy will certainly carry you and also your time.

Your capacity to lead staff members, offer clients, and also make choices might experience. Your time is likewise important and ought to be thought about when considering accounting prices. The moment invested in accountancy tasks does not generate revenue. The much less time you invest in accounting as well as taxes, the more time you have to expand your organization.

This is not meant as legal advice; to find out more, please click here..

Not known Facts About Tax Accountant In Vancouver, Bc